Home equity loan with bad credit wells fargo

Whatever you need a large loan for lenders usually dont make small loans because theyre not as profitable as large loans. Selling your home at a profit and relocating to a smaller less costly space could be the answer to your budget woes.

Wells Fargo Mortgage Review 2022 Smartasset Com

4 min read Aug 18 2022 Home equity loan or HELOC vs.

. A home equity line of credit with bad credit may be possible but bad credit HELOCs can be costly. Bank of America is a big bank lender that offers mortgage and refinance loan products along with full banking services. You might even opt to rent a place so you can avoid the hassles of homeownership.

Take out a home equity loan or a home equity line of credit HELOC. Heres how Wells Fargo says your FICO scores can affect your chances of being approved for a HELOC. There are more than 5000 branch locations in the US in addition to its.

The 2017 Tax Cuts and Jobs Act allows homeowners to deduct the interest on home equity loans or lines of credit if the money is used for capital improvements such as to buy build or. A home equity loan is meant for a single major expense. The smallest home equity loan available is about 10000.

As opposed to a HELOC the money from a home equity. Very similar to HELOCs as they use the equity in your home to secure the loan. A home equity loan or HELOC might be a less costly way to tap into your home.

The banks loan officer group offers home equity loans and home equity lines of credit based on the value of your home compared to your existing mortgage. Through a Wells Fargo Home Mortgage refinancing loan you may be able to pay off your mortgage sooner cut your higher interest rate lower your monthly payments or convert to a fixed mortgage rate. Home equity borrowers can deduct interest but only if they meet these requirements.

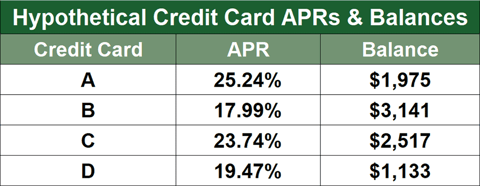

A cash-out refinance means youd take a loan with a 220000 balance and your lender would give you 20000 in cash. Some banks have minimum loan amounts of 25000 and others require borrowing at least 35000. For example imagine that your principal loan balance is 200000 and you want to cover 20000 worth of credit card debt with your equity.

Wells Fargo Mortgage Review 2022 Smartasset Com

![]()

Before You Apply Home Equity Wells Fargo

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Wells Fargo Autograph Credit Card Review Forbes Advisor

Is The Wells Fargo Home Rebate Card A Good Deal

Wells Fargo Heloc Review September 2022 Finder Com

Wells Fargo Mortgage Review Lendedu

Wells Fargo Personal Loan Review For 2022 Apr From 5 99

![]()

Before You Apply Home Equity Wells Fargo

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Wells Fargo Personal Loan Review Lendedu

Wells Fargo Personal Loan Review Lendedu

Wells Fargo Personal Loans Review 2022

Wells Fargo Personal Loan Review For 2022 Apr From 5 99

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Have A Personal Line Of Credit With Wells Fargo Do This Next Forbes Advisor